Rates from 9.9% APR: the exact rate you will be offered will be based on your circumstances, subject to status. Representative example: borrowing £7,000 over 5 years with a representative APR of 21.9%, the annual interest rate of 21.9% (Fixed) and a deposit of £0, the amount payable would be £185.33 per month, with a total cost of credit of£4,119.81 and a total amount payable of £11,119.81. We look to find the best rate from our panel of lenders and will offer you the best deal that you're eligible for. We receive a fixed fee commission per finance agreement, or we receive a commission based on a percentage of the total amount of finance taken. This will not affect the interest rate offered or the total amount repayable. Our service is free.

Meet our car finance lenders

Our close relationships with major lenders means we can find the right finance product at the best rate, getting you keys to your next car fast.

Ready to get the keys to your dream vehicle? Request a car finance quote and we’ll find the perfect deal to put you behind the wheel.

Norwich car finance calculator

- 36months

- 42months

- 48months

- 60months

This helps you get a more accurate finance estimate

Not sure about being approved?

Check finance eligibilityWon't affect your credit score

We are a credit broker not a lenderThese estimates are subject to credit checks, and may change if you do apply for finance.

£0/pm

£0/pm

| Loan amount | £7,500.00 |

|---|---|

| Length of Loan | 60 months |

| Monthly payment | £0 |

| Interest rate | 14.9% APR |

| Optional final payment | £0 |

| Amount of interest | £0 |

| Total payment | £0 |

Rates from 9.9% APR: the exact rate you will be offered will be based on your circumstances, subject to status.Representative example: borrowing £7,000 over 5 years with a representative APR of 21.9%, the annual interest rate of 21.9% (Fixed) and a deposit of £0, the amount payable would be £185.33 per month, with a total cost of credit of£4,119.81 and a total amount payable of £11,119.81. We look to find the best rate from our panel of lenders and will offer you the best deal that you're eligible for. We receive a fixed fee commission per finance agreement, or we receive a commission based on a percentage of the total amount of finance taken. This will not affect the interest rate offered or the total amount repayable. Our service is free.

At Moneyrepublic, we specialise in car finance in Norwich, offering you the best options for financing your next vehicle. We are committed to transparency, integrity, and exceptional customer satisfaction.

We provide two main types of car finance: Hire Purchase (HP) and Personal Contract Purchase (PCP). HP lets you own the car after completing your payments, while PCP offers lower monthly payments with the option to buy at the end.

Let us help you find the perfect financing solution tailored to your needs. Get in touch today to explore your options.

Apply for bad credit car finance in Norwich

Struggling with a poor credit score? At Moneyrepublic, we specialise in bad credit car finance in Norwich and are here to help you secure the car you need.

We understand that a less-than-perfect credit history can make financing a challenge. That’s why our dedicated team partners with top lenders to offer you tailored financing solutions, no matter your credit situation.

With our expertise, you can get the car you want with manageable terms. Don’t let bad credit hold you back. Contact us today to discover how we can assist you in financing your next vehicle.

Get no credit check car finance in Norwich

No credit check car finance allows you to secure a vehicle without a traditional credit check. This type of finance focuses on your ability to repay rather than your credit history.

For those in Norwich, this means you can avoid the stress of credit rejections that negatively impact your score. Instead, we use a ‘soft’ check to review your financial situation, which doesn’t affect your credit rating.

This approach ensures you get the car you need without added financial stress. Contact us today to explore no credit check options tailored to you.

Norwich no deposit car finance

No deposit car finance allows you to secure a car without any upfront payment, perfect for keeping your initial costs low. This option is ideal if you prefer to manage your budget more effectively.

At Moneyrepublic, we offer no deposit car finance deals in Norwich, ensuring you can drive away in your new car without the hassle of a large initial payment. While this might increase your monthly payments, it makes getting a car more accessible.

Contact us today to get a quote and explore the best no deposit finance options tailored to your needs.

Pay as you go car finance in Norwich

Pay as you go car finance, also known as black box car finance, is a flexible way to lease a vehicle. This system involves an initial payment and manageable monthly payments based on a Hire Purchase (HP) agreement.

With this option, applications are typically quicker and easier than traditional loans. You only pay for what you use, and you become the car’s owner after settling the vehicle’s residual value at the end of the contract.

At Moneyrepublic, we offer Pay as you go car finance deals in Norwich. Get in touch today to receive a personalised quote and find the best finance option for you.

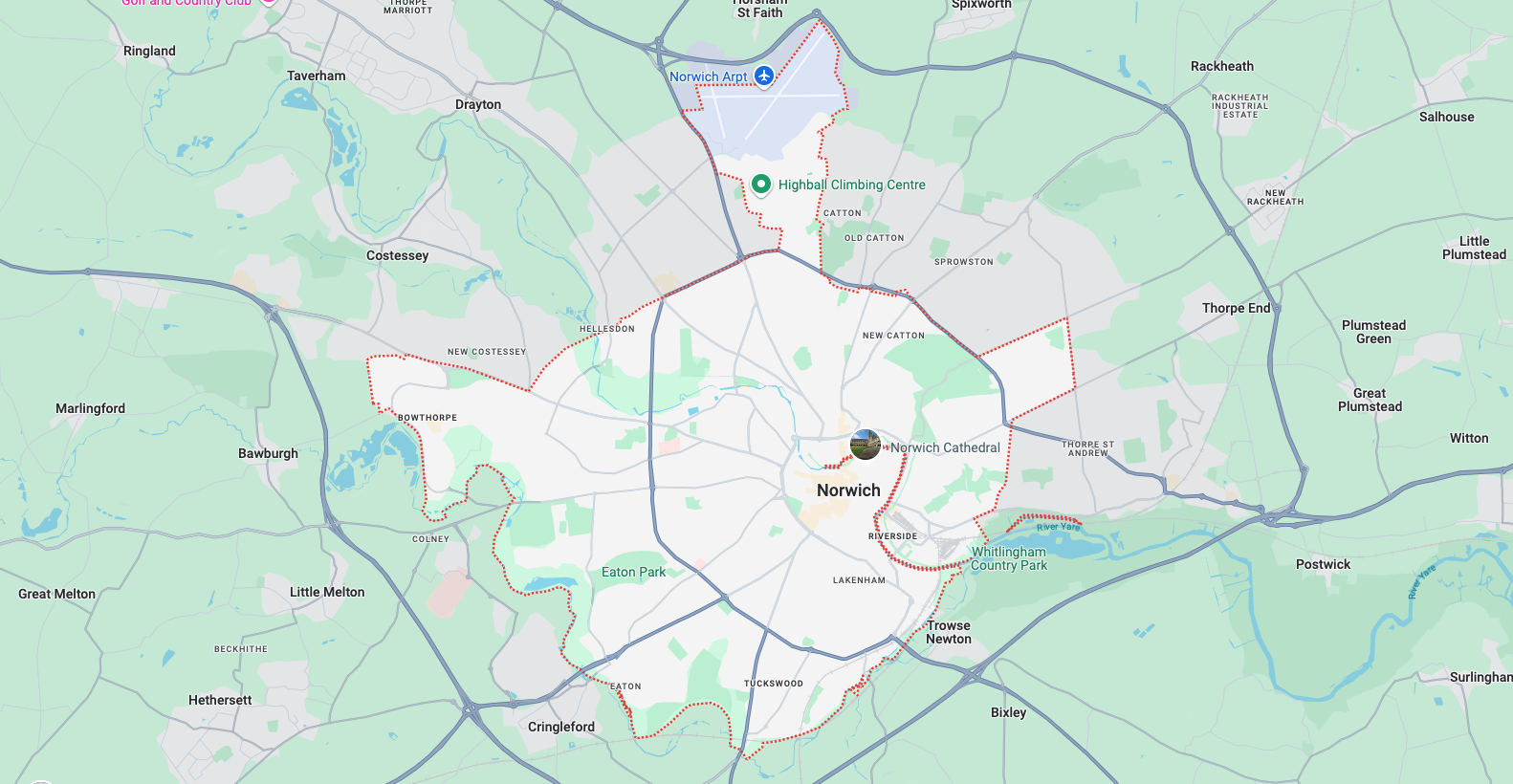

Dealerships you can find your next car in Norwich

Norwich Car Centre

14 Garden St, Norwich NR1 1QX, United Kingdom

Hammond Cars

William Frost Way, Costessey, Norwich NR5 0JS, United Kingdom

MB Cars Norwich Ltd

3A Aylsham Wy, Norwich NR3 2RF, United Kingdom

Swans Motor Group Ltd

231-245 Heigham St, Norwich NR2 4LN, United Kingdom

Who is eligible for car finance in Norwich?

To be eligible for car finance in Norwich, you must:

- Be aged 18-75 years old

- Have been a UK resident for at least 12 months

- Receive a monthly income of £1,000 or above

What do I need to get car finance in Norwich?

To qualify for car finance in Norwich, you will need:

- Proof of ID: Valid photo identification.

- Proof of Address: Recent utility bill or bank statement.

- Bank Statements: Recent statements to show your financial status.

- Payslips or Proof of Income: To verify your earnings.

- Small Deposit: If required by the finance plan.

Benefits of using a car finance broker in Norwich

Using a car finance broker in Norwich offers several key advantages. Brokers, like Moneyrepublic, have access to a wide range of lenders and financing options.

This means you get tailored advice and find the best deal for your needs. Brokers also simplify the process, handling paperwork and negotiations on your behalf.

By choosing a broker, you save time and potentially secure better rates. Contact us today to see how we can help you find the ideal car finance solution.

Car on finance is available to everyone in Norwich

Unemployed |

Self-employed |

In part time employment |

Zero hours contracts |

In receipt of benefit |

Young drivers |

Retired drivers |

Provisional license holders |

Carers allowance |

Disability allowance |

Ex bankrupt |

Bad credit ratings |

No credit history |

Military/Armed forces |

Why do you have to finance your next car with us in Norwich?

Get your car finance online

Get car finance options with no impact on your credit score.

Buy a car from any dealer

Once approved, collect or get your car delivered to you.

Car finance quality assured

We’ll do a thorough vehicle HPI, full-service history and MOT check. Buy with confidence.